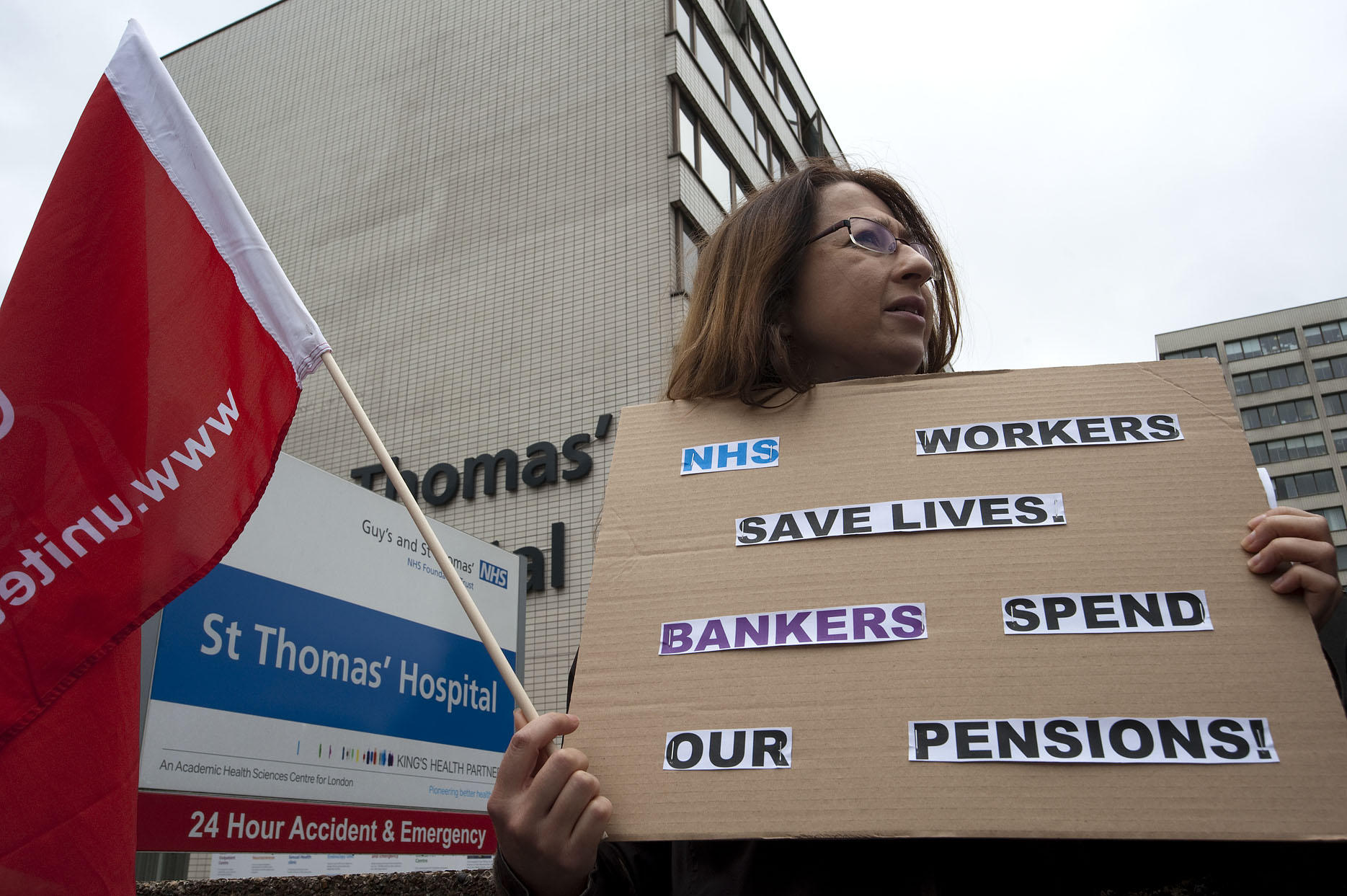

Not a penny more off our pensions and not a day longer at work!

By a local government worker in Unison

It’s been seven months since the magnificent strike on 30 November in defence of public sector pensions. Seven months with members being kept in the dark. On 31 May the deal that has been stuck at the top of the unions was announced. It is now to be subject to ballots in the different local government unions.

The proposal will affect 4.6 million working and retired workers. So we must be sure that we are not being robbed again, like we were in 2006, when £1 billion was taken off our pensions.

The long and short of this deal is “work longer, get less, pay more”. The local government scheme is not in financial difficulty. This is just another attempt by the government to steal money from the pockets of public sector workers.

Any concessions that have been won are because of strike action and the employers’ fear of another 30 November.

If the union leaders think this is a good deal achieved through negotiation, imagine what could be won if we fight alongside all the other union members still fighting to protect their pensions?

Details of the pensions proposals unpicked…

We are told that this deal means:

- For those under the age of 55 your normal retirement age will rise in line with the new state pension age – 67, 68 and then 70. This means many will have to work two, three and even five years longer.

- Pensions will only be uprated with the lower CPI inflation rate rather than the higher RPI rate. This measure alone has stolen billions off the current pensioners and those yet to retire.

- The final salary scheme is to be replaced with a career average scheme. We earn 1/60th of our salary in pension each year, the accrual rate. The final pension is 1/60th of our final salary multiplied by length of service.

In 2006 we fought to keep the final salary scheme and opposed the career average scheme, so why is it now being attacked by the union leaderships as only benefiting the higher paid?

The union officials are now claiming that the career average scheme is better, because it has a better accrual rate of 1/49th and will be uprated by the CPI inflation rate.

Most workers end up earning far more in their last years of working than when they first started. They will be rightly suspicious that taking their average salary over their whole career can be better than using their final salary.

Some of the examples the unions give seem to show we would be no worse off and in some cases better off with a 1/49th and CPI uprating but are we being given the whole picture?

Some months ago the unions said that in order to be better off or no worse off than under the final salary scheme we would need to get an uprating level of not just the inflation rate but inflation plus 2.5%. The reason for this is that history has shown over the long run pay rises are generally 2.5% higher than the inflation rate.

Despite this we are now being sold an uprating level of just the CPI inflation rate, 3% at the moment.

If we were given examples of CPI plus 2.5% it would expose the career average scheme as leaving many more workers worse off.

Our union leaders clearly don’t believe that we will be able to secure anything other than pay rises at or below inflation rate for the next 20 years.

- They say that no one will face an increase in contribution rates other than workers earning more than £43,000. We know in other schemes workers are being asked to pay more so many will be pleased by this concession. However some workers earning less than £20,000 will pay more. Let’s not forget we’ve been paying more for the last four years and had no pay rise for three of those.

- Part-time staff will now pay contributions based on their actual earnings, not the full time equivalent. This is an improvement as it was always unfair for part-time staff to have to pay a contribution rate based on the full-time equivalent earnings.

- Staff transferring to the private sector can remain in the pension scheme as a right from April 2014. This is an improvement, as at the moment private companies are only required to come up with a “broadly comparable scheme”. It’s not clear who will pay for this – the councils or the profit making companies.

- There will now be a 50/50 option. Effectively you can pay half the monthly contribution rate and get half the benefits. In other words, save now lose later. But the reason we are struggling is because we’ve had no pay rises for three years.

- The future costs of the scheme are yet to be resolved. This is a recipe for “vote now, pay more later”. In the health service they ended up with a deal where the employers were protected from increases and all the increased costs now fall on the shoulders of the workers.